Gustaf (Gus) Ericson is an associate partner with Bain & Co’s Financial Investor and Software practices based in Mumbai, where he advises both software-as-a-service (SaaS) companies and investors in SaaS. He works with early and late-stage investors on everything from asset identification to commercial due diligence. He advises enterprise technology companies on strategy, go-to-market (GTM), pricing and packaging, and IPO readiness, among other things.

Gus moved to India in 2013, after starting his career as an investment banker in London, and has more than a decade of experience in finance, tech, and consulting. In this interview with Crew Capital’s Dylan Reider and Sonia Damian, he shares insights on India’s SaaS boom and advice for Indian SaaS companies looking to break into the US market.

Highlights from the conversation:

India is now home to the world’s second-largest SaaS ecosystem after the US. What began as a hub for IT services, India is now a center of innovation, producing a growing cohort of global SaaS leaders. Investment in Indian SaaS has risen from $800m in 2018 to over $5bn in 2022 and Indian SaaS companies now account for ~$12-13B in ARR - up from $5-6B in 2019.

Indian SaaS companies are supported by a talent base that combines product & engineering excellence with increasingly refined, globally focused GTM strategies. Bain estimates that ~60% of revenues for top Indian SaaS companies are generated from the US market, creating an impetus for Indian SaaS companies to think about global expansion earlier than companies created in the US or EU.

In addition to building leaders in areas such as Dev Tools, Indian SaaS companies are also finding new ways to serve clients in mature categories such as CRM (customer relationship management) and HCM (human capital management), whether creating mobile-centric solutions given India’s internet audience is mobile-first, or addressing underserved client geographies and user segments.

Interview

Gustaf, thanks so much for joining us. Let’s start big picture. When you think back on your career, what are some lessons that stand out that you would want to impart to someone new to the software ecosystem, either as an investor, founder, or operator?

Two lessons come to mind that I’ve observed working with SaaS companies and investors. First, people continuously underestimate the shift in cloud and SaaS. I’ve seen so many cases where, early on, businesses look small or don’t seem to justify the valuations that they’re getting. Still, then they have this propensity to grow incredibly quickly. The second is that regardless of the company’s scale, every SaaS company is on an endless journey of learning and evolution, and there’s always something that’s changing or being tested and implemented. It’s an incredibly exciting space.

How should investors think about India in the context of the global market for software? What is new and interesting as it relates to the Indian SaaS ecosystem?

India is one of the most exciting emerging SaaS ecosystems in the world. India has always been a core player in the overall software ecosystem, whether through the IT services industry—which is a huge industry in India, just shy of 10% of GDP—or through early movers in Indian software like Zoho and Freshworks, which are becoming household names in the US as well.

But I think what makes it exciting for me is the more recent emergence—I’m talking the last three to five years—of a wider set of emerging global SaaS leaders that are originating out of India and are very rapidly selling and winning in the US. If we go by the numbers, in 2022 we had annual recurring revenue (ARR) of $12-13bn, and investment of about $5bn, so Indian SaaS has built serious momentum and, by our estimates, is second only to the US. It is a fascinating market, and I expect to see many more household names coming out of India soon.

What are some of the underlying changes taking place among the investor base that is catalyzing that growth?

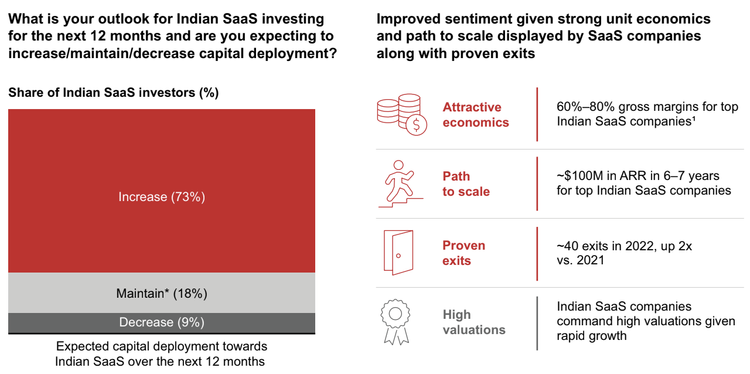

I’ll start by talking about scale. We had seen investment in Indian SaaS go from $800m in 2018 to over $5bn in 2022. This is a combination of venture and growth equity investments. We saw our first $1bn-plus deal in 2022 with Securonix, while the number and value of seed deals has more than doubled. There is tremendous momentum behind SaaS in India.

Then there’s the investor landscape. In its earlier incarnations, Indian SaaS was largely backed by prominent global and domestic SaaS ventures and growth equity funds. What we’ve seen happening over the past few years is that existing investors are doubling down on Indian SaaS and increasing their investments. Also new investors—especially later-stage global ones like NEA or Vista — are participating in scaled Indian SaaS deals for the first time.

Third, we’re seeing investors starting to play across the deal continuum, for example with growth investors increasing their seed participation and a greater interest in late-stage growth and control deals.

India has traditionally been seen as an engineering and services hub. Talent is more affordable relative to the US, but it seems like India is increasingly becoming a source of innovation. Why is that?

When we look at what makes India such an exciting place for software, there is an incredibly large pool of very talented engineers and, as you mentioned, historically from an outsourcing perspective there’s been a cost advantage as well. It’s still true that India is a software engineering hub, whether we talk about Indian SaaS companies or global SaaS companies that have Indian-based engineering teams, like UiPath. And the reality is that a substantial share of the world’s technical talent is still in India.

When it comes to software, India has always been a source of innovation both on the product side, in terms of engineering, and on the business side. The CEOs and executives running some of the most prominent US software companies—Microsoft, Adobe, Google, VMware Zscaler, and many others—are of Indian origin. So, in many ways, Indian SaaS innovation has been an export from the country, even if much of that innovation has historically taken place in the US.

But you’re right that the Indian SaaS story itself does feel comparatively more recent and that’s because Indian SaaS teams have now combined that historical product excellence with a more refined growth playbook when going into markets like the US. Ultimately why we’re seeing traction is because Indian SaaS companies are growing rapidly. I think what they’ve really cracked is, first of all, enterprise sales, but also product-led growth. Some of the most prominent global Indian SaaS companies have done tremendously well on the back of product-led growth, and this has enabled them to scale rapidly in a way that makes them global contenders.

Are there particular types of enterprise software that India is producing, say the way Israel is particularly effective at spawning cybersecurity companies?

There’s no shortage of super exciting companies coming out of India across the whole range of SaaS sub-sectors. If we look at the leaders in Indian SaaS by revenue, it ranges from cyber and data security companies like Securonix and Druva, to conversational AI companies like Uniphore. There are also numerous verticalized SaaS companies, like Amagi in media, or Innovaccer in healthcare, and then you have your broader, horizontal application suites like Zoho and Freshworks—not to mention hundreds of other rapidly-growing companies. So pick a subsector, and you will see Indian SaaS leaders, there’s not a single sub-sector, in my opinion, that dominates Indian SaaS.

Tell us more about some of the unique qualities in the Indian SaaS ecosystem.

One way is that the software providers offer highly mobile-friendly applications. Remember, India didn’t have the same desktop-first internet adoption—people went straight to mobile when data became ubiquitous in the mid-2010s. As a result, we see a number of CRM and sales enablement companies like CleverTap and MoEngage innovating with mobile-centric offerings.

Another interesting angle is that the Indian SaaS ecosystem serves newer geographic areas that are close, but may not have the same SaaS scale as India. Specifically, I’m speaking about the ‘nearshore’ markets of Southeast Asia and the Middle East, which have historically been served by companies in other SaaS hubs like the US or EU.

A third element of the Indian ecosystem is its natural advantage in building developer tool companies. And by that, I mean everything from infrastructure software like Postman, to application testing or cross-browser testing platforms like Browsersack or LambdaTest, or device deployment and app management tools like Esper. India has 10% of the global population of developers based on GitHub, which creates a natural foundation for spawning new and interesting companies focused on building developer tools.

We’re experiencing a high degree of market turbulence right now in the US and EU, particularly in the private markets. Are markets in India having a similar experience right now?

India overall, and Indian SaaS, in particular, has definitely not been immune to market turbulence. When we look at 2022 in India, while overall funding was up, a lot of that was driven by activity in Q1 when funding for SaaS was about 2.5 times higher than in 2021. In every quarter thereafter, it has come down vs. the prior year, so the market has definitely slowed down here too. This is partly because later-stage deals aren’t happening, and they have historically been a large share of total investment. And that’s not just because investors aren’t willing to deploy capital, but because many later-stage Indian SaaS companies have chosen to stay out of the market as they haven’t always needed to raise capital, and valuations have come down.

We’ve also certainly seen a mindset shift away from a ‘growth at all costs mentality’. There’s more emphasis on efficiency and managing costs and liquidity. But we’ve not had the same kind of headline-grabbing layoffs we’ve seen elsewhere, so that’s another distinction.

What are the most common questions, topics, or operational initiatives that software companies engage you and Bain for help on?

The number one is always GTM and growth. That can be anything from picking new markets to expand into, or from how to design and build a GTM organization. Number two is pricing and packaging. And I think the final one that we’ve typically seen a lot of, for later-stage companies, is IPO readiness. There’s a huge step going from being a scale private company to a public company. It involves a tremendous amount of readiness: everything from technical readiness, to crafting an equity story, to finance and accounting.

And what do you see as the top mistakes that companies tend to make when they expand from India into the US?

Mistakes are a very natural part of the learning process when it comes to growing companies. To tie it back to India, companies here are rapidly adjusting the speed with which you have to iterate and enter new markets. For example, SaaS companies have historically often delayed going into new markets including the US. But when we look at leading Indian SaaS companies today, we estimate that ~60% of revenues are generated in the US, and even $10m ARR companies now frequently have a US-based team focused on sales. What we’ve seen is that companies are realizing that this evolution typically needs to happen sooner rather than later.

You mentioned pricing and packaging. This can often be one of the more challenging subjects for early-stage software companies, how to effectively price their products. What are some common mistakes you see as it relates to pricing/packaging? What would you advise companies when they come to you on GTM strategy and going into the US, for example on pricing and packaging?

We have found there are a few key elements to creating ‘good’ pricing and packaging. The first is being clear on the ‘why’ – companies need to be clear on what they’re trying to achieve with their pricing and packaging – whether it is profitability, growth or something else altogether. Secondly, it’s being clear on the ‘who’ – who are your customers and how do you segment them by their needs? This is a critical step as without a robust understanding of who you are serving, creating packages and tiers can fall flat. Thirdly, too much pricing and packaging complexity – be it the complexity of a price meter or packaging permutations – is a common pitfall.

However beyond just creating packages, effective pricing and packaging is also about having an effective rollout strategy that involves all stakeholders – it’s not just enough to have a grid of on your website with different options. Sales, finance, marketing and product should ideally be a part of the pricing and packaging process from start to finish. For example, we’ve seen numerous examples where pricing and packaging have been done in isolation, without sales teams being empowered with the tools to communicate that pricing and packaging effectively to customers in a streamlined fashion, leading to significant friction post-rollout.

Thank you for this awesome conversation today. Any last words of advice?

Don’t underestimate SaaS, and especially don’t underestimate Indian SaaS. We’re still in the early innings! If you look at the entirety of the Indian SaaS industry today, it’s not even the size of Salesforce in terms of ARR, but it’s growing incredibly rapidly. What we have seen is that you don’t need to be a US-born company to succeed in the US, and I think that it’s an exciting decade ahead for Indian tech and especially for Indian SaaS.

Related Articles

Sasha Reminnyi: Leading a Ukrainian Startup to Acquisition

In our most recent discussion in our ongoing interview series, we had the pleasure to speak to Sasha Reminnyi. Sasha…

Dan Farley: How Customer Success Builds Durable Enterprise Value

Dan Farley, VP of Customer Success at Lunio, recently sat down with Crew Capital portfolio companies for a roundtable to…

Navigating the Intersection of Technology and Leadership with Melanie Kirkwood Ruiz, CIO/CTO of ABM Industries

Melanie Kirkwood Ruiz is a world-class technology leader best known for her role as the Chief Information and Technology Officer…